Our Commitment

Cougar Global is committed to providing clients with attractive long-term compound returns with a focus on minimizing downside risk.

In a proprietary fashion, we combine "postmodern portfolio theory," "rational beliefs" understanding of the behavior of global capital markets, "bootstrapping" statistical simulation techniques, and multiple macroeconomic scenario analyses.

Cougar Global has been using the same investment philosophy since 1993, and we constantly refine our investment process. The emergence of ETFs in recent years has enabled us to fully implement our investment expertise.

Our Process

We apply a dynamic three-step global macro-oriented asset allocation process,

with a strong focus on downside risk management.

Macroeconomic Scenario Analysis (Outlook)

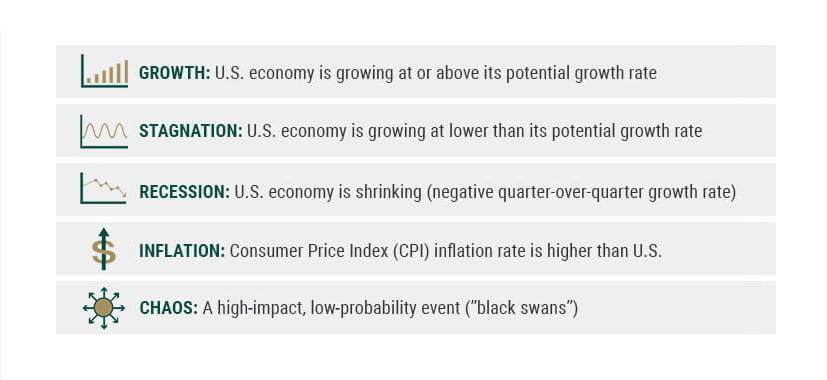

After considering macroeconomic and other global trends, the team assesses the U.S. economy's 12-month outlook for:

Bootstrapping (Simulate Asset Class Returns)

Using our Macroeconomic Scenario Analysis results, we then apply advanced statistical techniques – and our professional judgment – to estimate how each asset class may perform over the forecast horizon. The recognition that asset classes perform differently depending on how investors react to the incoming macroeconomic information is at the core of Cougar Global’s philosophy.

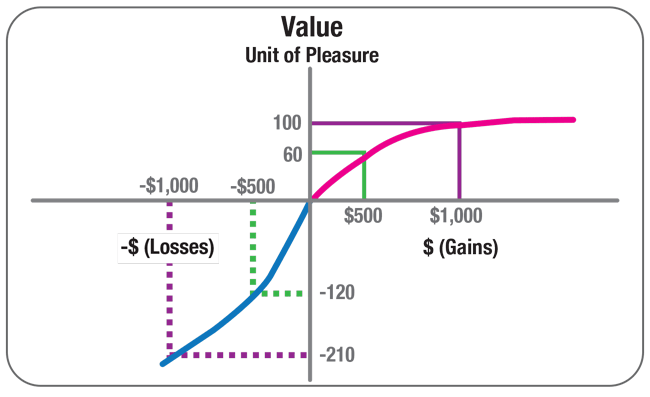

In constructing portfolios, we apply a variation of Post Modern Portfolio Theory. We focus on the “Probability of Loss” at the total portfolio level as our preferred measure of risk. We believe “Probability of Loss” recognizes a key behavioral finding that individuals have an asymmetrical attitude towards gains and losses, feeling significantly more “pain” from a dollar lost than “pleasure” from a dollar gained, as illustrated below.

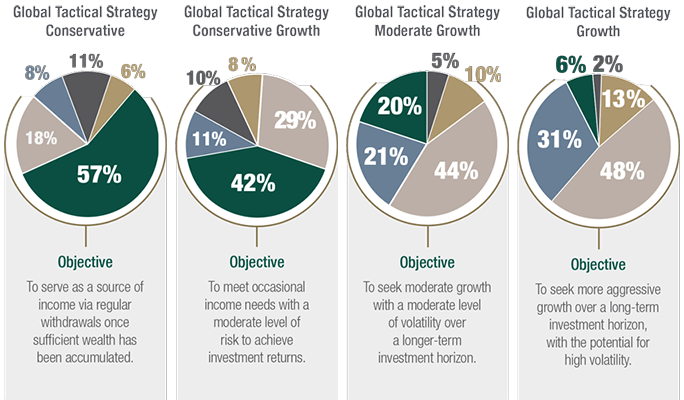

Construct Portfolios (Downside Risk Management)Our team analyzes the probability distributions for each asset class and the correlations among them to generate the optimal asset mix for each investment mandate for that month. Cougar Global’s proprietary portfolio optimizer seeks the highest expected return constrained to the specific level of downside risk consistent with the mandate. |

|

|

Source: Cougar Global Investments. All investments are subject to risk. There is no assurance that any investment strategy will be successful.